Download data

library(FinCal)

# history data from start (1993) to today

SPY <- get.ohlc.yahoo("SPY")

head(SPY)

date open high low close volume adjusted

5308 1993-01-29 43.97 43.97 43.75 43.94 1003200 29.78

5307 1993-02-01 43.97 44.25 43.97 44.25 480500 29.99

5306 1993-02-02 44.22 44.38 44.13 44.34 201300 30.05

5305 1993-02-03 44.41 44.84 44.38 44.81 529400 30.37

5304 1993-02-04 44.97 45.09 44.47 45.00 531500 30.50

5303 1993-02-05 44.97 45.06 44.72 44.97 492100 30.48

# adjusted closing prices

SPY.Close <- SPY$adjusted

SPY.vector <- as.vector(SPY.Close)

# Calculate log returns

sp500 <- diff(log(SPY.vector), lag = 1)

# Remove the NA in the first position

sp500 <- sp500[-1]

head(sp500)

[1] 0.001999 0.010593 0.004271 -0.000656 0.000000 -0.006914

Compute the first four moments of the data

library(GLDEX)

# output is the set of estimated lambda parameters λ1 through λ4 for both

# the RS version and the FMKL version of the GLD.

spLambdaDist = fun.data.fit.mm(sp500)

spLambdaDist

RPRS RMFMKL

[1,] 4.711e-04 4.038e-04

[2,] -4.381e+01 2.081e+02

[3,] -1.700e-01 -1.723e-01

[4,] -1.662e-01 -1.635e-01

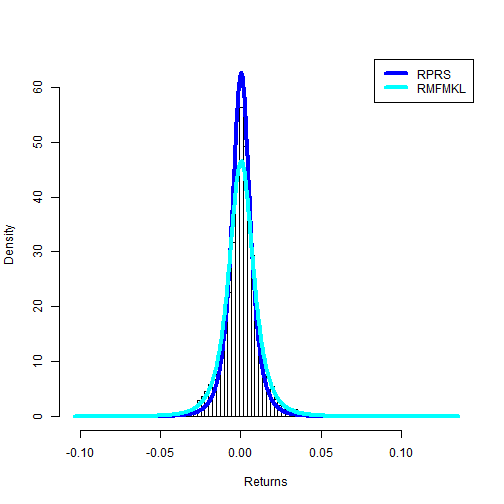

# histogram plot of the data along with the density curves for the RS and

# FMKL fits

fun.plot.fit(fit.obj = spLambdaDist, data = sp500, nclass = 100, param.vec = c("rs",

"fmkl"), xlab = "Returns")

Simulate returns using parameters generated by last step

# RS parameters

lambda.params.rs <- spLambdaDist[, 1]

lambda1.rs <- lambda.params.rs[1]

lambda2.rs <- lambda.params.rs[2]

lambda3.rs <- lambda.params.rs[3]

lambda4.rs <- lambda.params.rs[4]

# RS simulation

set.seed(999)

rs.sample <- rgl(n = 1e+07, lambda1 = lambda1.rs, lambda2 = lambda2.rs, lambda3 = lambda3.rs,

lambda4 = lambda4.rs, param = "rs")

# FKML parameters

lambda.params.fmkl <- spLambdaDist[, 2]

lambda1.fmkl <- lambda.params.fmkl[1]

lambda2.fmkl <- lambda.params.fmkl[2]

lambda3.fmkl <- lambda.params.fmkl[3]

lambda4.fmkl <- lambda.params.fmkl[4]

# FKML simulation

set.seed(999)

fmkl.sample <- rgl(n = 1e+07, lambda1 = lambda1.fmkl, lambda2 = lambda2.fmkl,

lambda = lambda3.fmkl, lambda4 = lambda4.fmkl, param = "fmkl")

Comparing results for the RS, FKML simulation vs S&P 500 market data

# Set normalise='Y' so that kurtosis is calculated with reference to

# kurtosis = 0 under Normal distribution

# Moments of simulated returns using RS method:

fun.moments.r(rs.sample, normalise = "Y")

mean variance skewness kurtosis

3.418e-04 9.457e-05 -1.027e-01 9.947e+00

# Moments of simulated returns using FMKL method:

fun.moments.r(fmkl.sample, normalise = "Y")

mean variance skewness kurtosis

0.0003415 0.0001481 -0.1029554 9.9199126

# Moments calculated from market data:

fun.moments.r(sp500, normalise = "Y")

mean variance skewness kurtosis

0.0003428 0.0001477 -0.1056554 9.9116401

FKML gets better results especially for skewness and variance. Compare to two parameters normal distribution, four parameters generalized lambda distribution is able to preserve skewness and kurtosis of the observed data.

For more details, read the original post here